Better Credit Decisions Start with Better Data

Accept more applicants while reducing risk. Aloan combines traditional credit with alternative data sources to give you a complete view of every borrower.

Manage Your Lending Workflow with Aloan

From application to approval to ongoing monitoring — all in one platform

Streamline Onboarding

Easily collect the right information from the borrower with a white labeled application and customer portal

- Connect credit bureaus & banks

- Verify identity & employment

- Collect documents automatically

Smarter Decisions

Leverage alternative data sources to expand lending and reduce risk beyond traditional credit scores.

- Cash flow & bank transaction analysis

- Auto-extract financial metrics

- Configurable risk policies

Ongoing Monitoring

Detect default risk early, identify upsell opportunities, and improve operational efficiency.

- Automated credit checks

- Early warning alerts

- Portfolio risk management

See Beyond the Credit Score

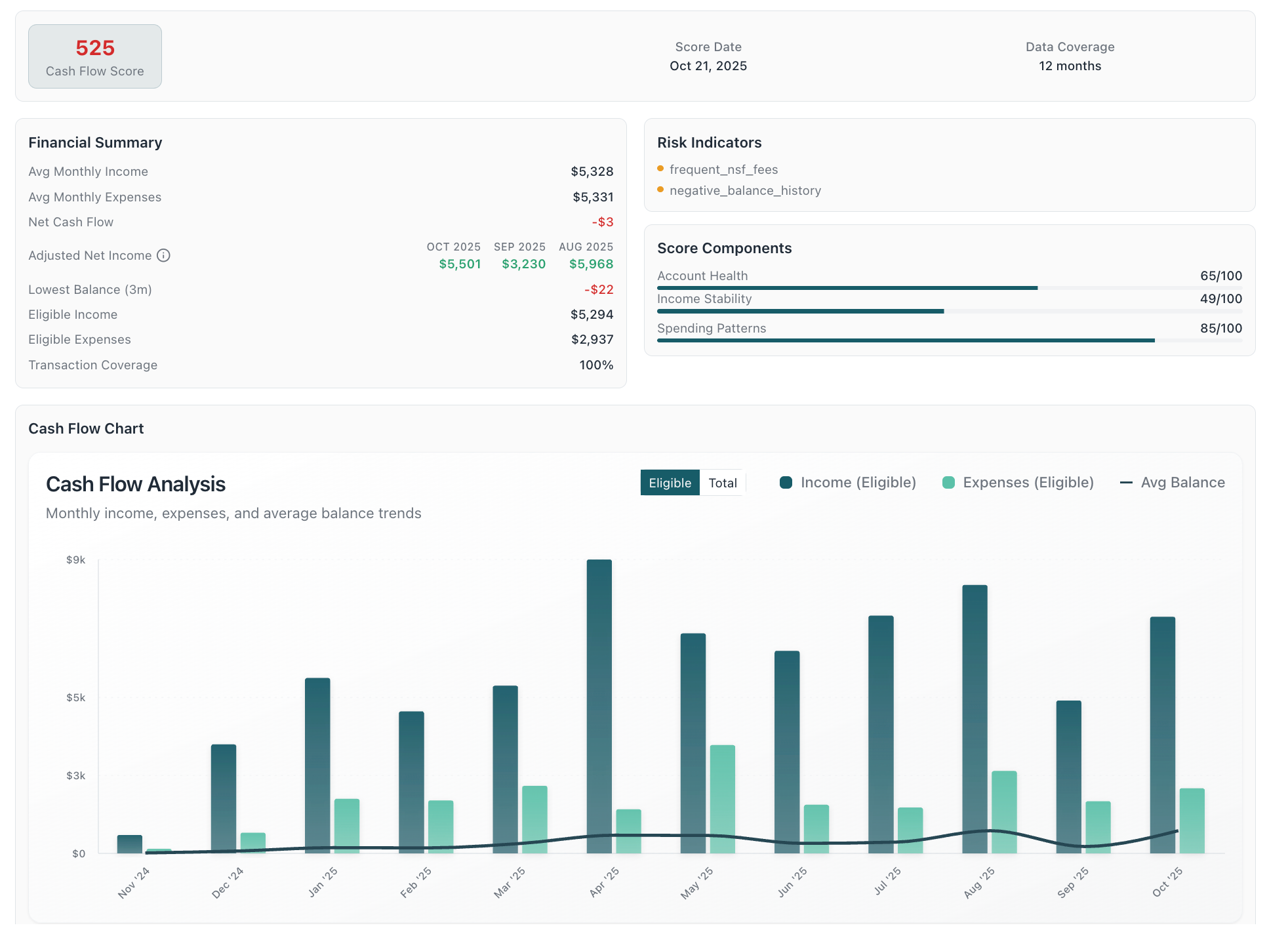

Our AI analyzes bank transaction data to generate comprehensive cash flow reports—giving you deeper insights into borrower financial health and repayment capacity.

Real-Time Cash Flow Scoring

Instant scoring based on 12+ months of bank transaction data.

Income & Spending Analysis

Track income stability, expense patterns, and net cash flow trends

Automated Risk Detection

Flag NSF fees, negative balances, and other warning signs automatically.

Build Trust with Verified Identity Mesh

Seamlessly verify customer identities by cross-referencing data across applications, government IDs, bank accounts, and credit bureaus. Our identity mesh technology ensures every data point tells the same story.

Comprehensive KYC Verification

Built-in identity verification checks government IDs, facial recognition, and liveness detection

Cross-Source Identity Matching

Automatically verify names, addresses, and dates of birth across all connected data sources

Real-Time Fraud Detection

Flag inconsistencies and suspicious patterns before they become problems

Seamless Customer Experience

One-time verification with instant results—no repeated document uploads or delays

Integrate Alternative Data Sources

Go beyond traditional credit scores to expand lending to new customer segments

Bank Transaction Data

Real-time cash flow analysis and spending patterns

- Income stability & consistency

- NSF & overdraft detection

- Expense categorization

Employment & Income

Verify employment income and employment history

- Payroll data verification

- Employment history verification

- Income stability analysis

Alternative Payment History

Utility, rent, and subscription payment data

- Utility payment records

- Rent payment history

- Subscription consistency

Identity & Fraud Detection

Comprehensive KYC/KYB and fraud prevention

- Identity verification

- Fraud risk scoring

- Document authentication

Enterprise-Grade Security & Compliance

Built for regulated financial institutions with the highest standards

Bank-Level Encryption

Access Controls

Regulatory Compliant

Audit Logging

Start Making Better Credit Decisions Today

Accept more applicants while reducing risk with the industry's leading credit data platform.